To apply, you need to be 18+ and a UK resident.

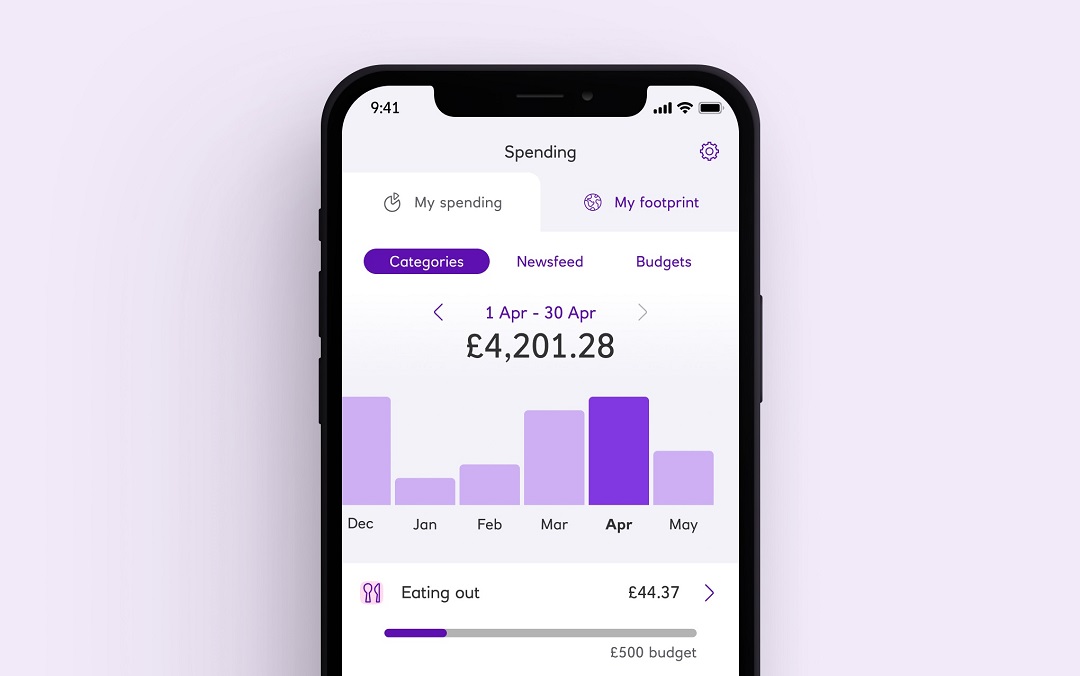

Mobile banking screen showing budgeting activity

Mobile banking screen showing budgeting activity Budget better, spend less

Spending will put your transactions in to categories, giving you a detailed view of where your money is going.

Available to customers aged 16+ who hold a Personal or Premier current account.

Mobile banking screen for viewing Credit Score

Mobile banking screen for viewing Credit Score Know your score

With our mobile app you can keep up to date with your credit score for free.

Available to customers aged 16+ who hold a Personal or Premier current account.

Mobile banking screen for Open Banking

Mobile banking screen for Open Banking View your accounts with other banks

View balances and transactions on selected accounts with participating UK banks. All your money on one screen.

You need to be registered for online banking with your other banks.

Overdraft details

How to open a bank account online

Switch to Royal Bank

The Current Account Switch Service will do all the work when it comes to switching, moving everything across from your old account all within 7 working days, including Direct Debits and standing orders. All you need to do is tell us the details of your old bank account and when you want the switch to start.

We can not switch savings accounts or ISAs through this service. Any other products you have with your old bank will not be moved at the same time.

Current Account Switch Guarantee (PDF, 39KB)

Everyday current account – Frequently asked questions

If you carry on applying, it means you're happy with what's in these documents, including the FSCS information sheet. And happy to view your statements in Digital Banking - not posted. Please take some time to review, print and/or save the important information.

Get a financial health check

Review your finances with our free financial health check. Fill in a few details and get useful hints and tips.

Learn how to manage your money

It can be tricky to know where to begin when it comes to saving money. But our quick guide can help point you in the right direction.

Get better at budgeting

Setting yourself budgets is a brilliant way to get your spending under control. In a few simple steps you could be saving money in no time.