On this page

My account

Explore your account and benefits

To view any benefits and get the most out of your current account, simply pick the account you have with us.

Switch to Royal Bank of Scotland

Switch a current account held elsewhere to your existing account using the Current Account Switch Service.

Upgrade or change my account

If you'd prefer one of our other accounts, you can change your account online. It's quick and easy to change.

If you're not sure which account to change to, you can explore our current account range.

You need to be a current account holder, 18+ and a UK resident. If you're a non-UK resident, once your account has changed to a Select account you'll be unable to upgrade to any Reward accounts. Specific account eligibility and monthly fees may apply.

Make a change to your account

You can set up a joint bank account with a range of our savings and current account products, excluding Student and children's accounts.

We could also help you to make other changes to your account:

- Add or remove an account holder

- Add a third party cardholder

- Add a Power of Attorney

- Add a Court of Protection/Scottish Financial Guardianship

Check your credit score for free

Get on top of your finances by regularly monitoring your credit score in our app.

Available once opted in through the app to customers aged 18+ with a UK address and is provided by TransUnion.

Approve a transaction

If you've got your notifications turned on, you can tap the notification to go straight to your app. Otherwise, log in to your app and tap the 'Approve a transaction' tab at the top of the home screen.

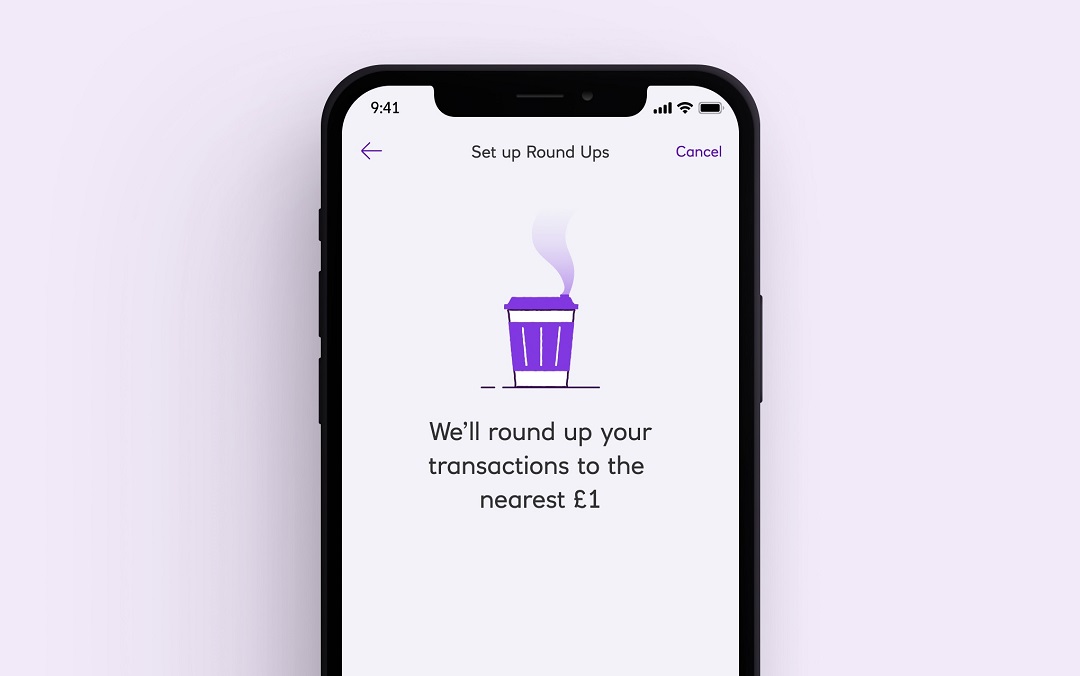

Save your spare change with Round Ups

Pay with your debit card and we'll round up the amount to the nearest pound, then send the spare change to your savings account.

Save little and often and the pennies soon add up. Eligibility criteria and limits apply.

Our app is available to personal and business banking customers aged 11+ using compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries.